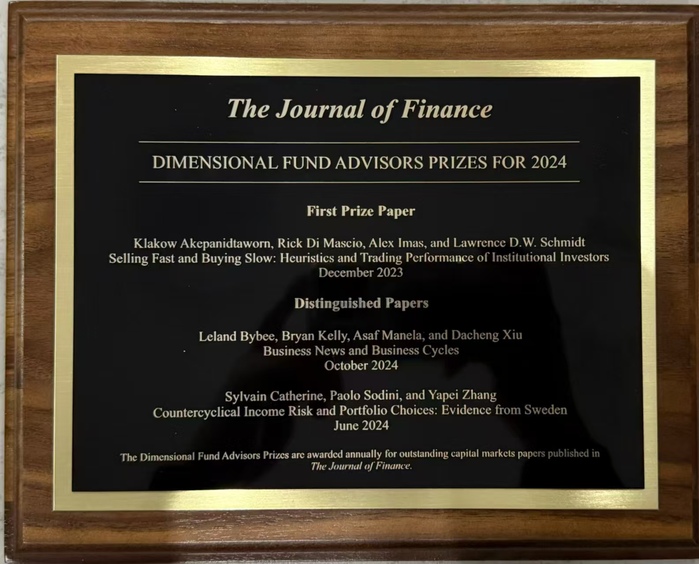

At the annual conference of the American Finance Association (AFA) held in San Francisco on January 3, the paper titled “Countercyclical Income Risk and Portfolio Choices: Evidence from Sweden” by Assistant Professor Zhang Yapei from the School of Entrepreneurship and Management (SEM) at ShanghaiTech University, along with her collaborators, won the Dimensional Fund Advisors Prize for 2024—Distinguished Papers.

About the prize

The Dimensional Fund Advisors Prize is a prestigious global award in the field of finance, established by AFA in 1989. It recognizes the best papers, excluding corporate finance, published in the Journal of Finance. This honor acknowledges Prof. Zhang Yapei and her collaborators’ contributions to research in household finance and highlights the academic excellence of young faculty at SEM.

About Zhang Yapei

Zhang is an assistant professor of finance at SEM. She earned her master’s degree from École Polytechnique and a PhD in Finance from HEC Paris. Her research has been published in academic journals such as Journal of Finance and Critical Finance Review. Her current research focuses on household finance, entrepreneurial finance, and fintech.

Introduction to the awarded paper

Title: Countercyclical Income Risk and Portfolio Choices: Evidence from Sweden

Abstract: Using Swedish administrative panel data, we document that workers facing higher left-tail income risk when equity markets perform poorly have lower portfolio equity share. In line with theory, the relationship between cyclical skewness and stock holdings increases with the share of human capital in a worker’s total wealth and vanishes as workers get closer to retirement. Cyclical skewness also predicts portfolio differences within pairs of identical twins. Our findings show that households hedge against correlated tail risks, an important mechanism in asset pricing and portfolio choice models.